Markets

Wärtsilä focuses on the marine and energy markets with products, solutions, and services. Our target markets are sensitive to business cycles. However, this is offset by the somewhat different business cycles in the various market segments. Wärtsilä’s manufacturing model brings flexibility to both manufacturing and cost structure through outsourcing and supports profitability independently of the business cycle.

Decarbonisation and digitalisation transforming marine operations

The transition towards decarbonised operations is of paramount importance to the maritime industry, and stricter regulations on ship emissions are expected to come into force worldwide. Over the coming years, industry players must work together to develop economically viable options that meet the International Maritime Organisation’s (IMO) emission targets. The IMO aims to reduce the average carbon dioxide emissions of maritime transport operations and to achieve zero greenhouse gas emissions by or around 2050. Furthermore, the EU is set to include shipping in its emissions trading scheme, while green finance has gained traction with increased attention on green bonds and sustainability linked loans.

Vessel owners must embrace changes in four areas for the transition towards decarbonisation to succeed:

- A shift in energy sources and fuels towards green alternatives

- The use of abatement technologies to remove harmful emissions

- The adoption of technologies that improve energy efficiency

- The use of data to optimise voyage and operational factors

The adoption of alternative fuels is key to the achievement of GHG targets. Significant investments have been made in zero-carbon fuels, such as green ammonia and hydrogen. However, LNG remains the most well-developed alternative. The abatement of local pollutants is also a key focus area, where the global sulphur cap set by the IMO came into force at the beginning of 2020. This means that ships have either to use low-sulphur fuel or install scrubbers.

Significant leaps in energy efficiency are also possible through the application of innovative technologies, both in newbuild and retrofit projects. These include hybrid systems, hull air lubrication, rotor sails, as well as advanced rudder and propeller designs. The drivers for the implementation of new solutions are balanced between the common effort to reduce emissions and the potential for lowering operating costs. In the context of digitalisation, fleet optimisation solutions are increasingly being acknowledged as central to the global requirement for reducing operating costs, while complying with environmental ambitions. New digital applications and cloud-based remote solutions are gaining traction, while ship-to-port communications, as well as document and data exchange, are increasingly being handled electronically rather than via personal interaction. In parallel, different degrees of autonomous shipping are being explored as a key means for boosting fleet efficiency, safety, environmental sustainability, and overall operational performance.

Marine markets in 2024

The

growth in global trade volumes, combined with a shift in trade flows resulted

in a significant boost in demand for ship capacity in 2024. The seaborne trade

flows shifted due to the sanctions on Russia, the wars in Ukraine and the

Middle East, attacks on ships in the Red Sea, and limited access to the Panama

Canal. The longer average shipping distances drove up transportation costs and

created delays to global supply chains.

Investments

in new ships were clearly above the levels seen in 2023, driven by the

increasing demand for ship capacity, growing pressure to decarbonise

operations, continued healthy earnings for shipowners, low orderbooks in the

ferry, offshore, tanker and bulk carrier segments, and continued fleet renewal.

In total, 2,765 new ship contracts were reported between January–December,

compared to 1,977 contracts signed in 2023. Despite the efforts to increase

shipyard capacity and output, especially in China, but also in South Korea,

shipyard capacity utilisation rates remain high and shipyard orderbooks remain

long, indicating that a shortage of yard capacity still exists. According to

Clarksons Research, global shipyard capacity reached its low point in 2020 at

around ~60% of 2011 peak level. It is currently at ~70% of the peak and could

increase to 80-85% by 2030, mainly as a result of yard reactivations and

expansions in China.

The

regulatory drive to decarbonise shipping pushed shipowners to increase their

investments in ships that can use alternative fuels, or which can be later

converted to use alternative fuels or other energy saving technologies. In

2024, 653 orders for new alternative fuel capable ships were reported,

accounting for 24% (23) of all contracted vessels and 49% (43) of the capacity

of contracted vessels.

In

the cruise segment, market sentiment remained very positive due to the

continued strong demand for cruise vacations. The strong growth in demand and a

positive outlook for the sector increased the appetite for ordering new cruise

ship capacity. Furthermore, the demand for service was supported by the

continued growth in active fleet capacity, as well as interest in efficiency

improvements needed for regulatory compliance and lower operational costs.

In

the ferry segment, the positive market sentiment was driven by the continued

but gradual recovery in economic activity across key markets. This coupled with

the aging fleet and the regulatory drive to cut carbon emissions, drove an

increase in the appetite for new ship capacity. The demand for service was

supported by the operator interest in maintaining and improving the efficiency

of their aging fleets.

In

the offshore segment, energy prices supported the sentiment in the oil &

gas market. The continued strength in demand for offshore assets especially in

South America and Asia, to support exploration activity, enabled day rates to

pass previous record highs, while supporting the utilisation rates for existing

assets. Newbuild contracting activity increased compared to 2023 but high

prices, the cost and availability of finance, as well as the shortage of yard

capacity limited the overall appetite. Sentiment in the Asian and European

offshore wind sector was supported by the easing of inflation and lower

interest rates leading to improved project economics. However, uncertainty over

the near-term outlook for the sector in the USA had a negative impact on the

sentiment. The investment appetite for newbuild vessels was mixed, with

activity in Construction Service Operation vessels (CSOV) remaining strong

while overall activity declined. The demand for service across offshore

sub-segments was driven by high utilisation and day rates, as well as interest

in retrofits to improve the efficiency of assets.

In

the LNG carrier segment, market sentiment remained softer than in previous

years, as strong fleet capacity growth clearly exceeded growth in demand which

led to a decline in the utilisation rate of the mostly older steam

turbine-powered ships. However, the appetite for newbuild capacity was clearly

above 2023 levels as a result of further capacity requirements to cater for the

demand in expanding LNG liquefaction capacity. Service demand was supported by

the growth in active fleet capacity and continued interest in service

agreements.

In

the container ship segment, sentiment was positive as trade volumes and the

rerouting of ships away from the Red Sea contributed to higher-than-expected

demand for ship capacity. Supported by the positive sentiment and the drive to

replace older tonnage, the investment appetite for newbuilds clearly picked up

compared to 2023. The sentiment in demand for service was supported by the

growth in active fleet capacity and earnings, as well as by shipowner interest

in retrofits to existing fleets.

Across

all the above segments, the growing pressure to decarbonise operations

supported the demand for both newbuilds and service. This has resulted in

investments in additional fleet capacity, direct fleet replacements, efficiency

upgrades or fuel conversions, and maintenance activities to keep the existing

fleet compliant and competitive.

Market forecast

Wärtsilä continuously monitors the shipping market environment through various channels. One key source of information for understanding the marine industry is Clarksons Research. Clarksons Research specializes in comprehensive data, analysis and insights on shipping, shipbuilding, offshore and energy markets. Clarkson’s forecasts are updated twice a year, at the end of March and September.

Clarkson’s forecasts in September 2024:

- 2,203 vessels (> 2,000 dwt/GT) in 2024 (+17% from March 2024 forecast)

- 1,948 vessels (> 2,000 dwt/GT) in 2025 (+5% from March 2024 forecast)

The surge is driven by strong investment appetite in containerships, tankers, and ongoing demand in LNG and cruise sectors.

- 24 cruise ships in 2024

- 20 cruise ships in 2025

- 200 offshore units in 2024

- 227 offshore units in 2025

- 322 container ships in 2024

Forecasts indicate that the demand for new ships will remain strong even in the longer term, especially due to the green transition and the ageing of the ship fleet. In the period 2024-2034 new ship orders are expected to accelerate into the 2030s with an average of 2,202 ships to be ordered per year. Approximately 65% of the ordered ship capacity is expected to replace the older fleet during this period. For example, 35% of the tonnage and approximately 65% of new ship deliveries now have at least one energy efficiency-improving solution installed, while the corresponding figures were 25% and 50% in 2020.

Clarksons predicts that the shipyard capacity could reach 80-85% of the 2011 peak level by 2030. Today the shipyard capacity is around 70% of the 2011 peak level and around 15% above the 2020 low point.

Read more about Clarksons Research forecasts for marine markets here.

Focus on energy transition and flexibility

Wärtsilä’s operating environment is influenced by the ongoing energy transition. A more sustainable energy infrastructure is emerging, driven by economics and climate policies. The past decade has witnessed growing investments in solar and wind energy, as these technologies have become the cheapest source for new bulk electricity in two thirds of the world. By 2030, solar and wind technologies are expected to become cheaper than existing baseload generation almost everywhere. The cost of energy storage technology has also plummeted. The storage market is expected to grow rapidly in the coming years, driven by economies of scale and technology development. In parallel, climate policies, such as tightening emissions legislation, are forcing the closure of ageing carbon-intensive energy sources, thus further encouraging the deployment of renewable energy.

The intermittent nature of solar and wind generation is gradually beginning to impact the running hours of conventional thermal capacity designed typically for baseload operation. The role of power system flexibility has thus become a topic of growing importance, as it will be a key enabler of sustainable power systems in the future. Flexible gas-based generation and energy storage are the key solutions for meeting future power system reliability and flexibility needs. Power-to-X solutions will further support reaching the 100% share of renewables in power systems.

In emerging markets, electricity demand is increasing, along with economic growth and improving standards of living. Interest in renewable energy sources is also increasing rapidly as a result of lowering costs, but conventional thermal technology still plays a key role in power production in emerging countries. Demand is the highest for flexible technologies that can adapt to an increasing share of renewables in the future, thus enabling the most sustainable and affordable power systems.

Natural gas continues to be considered as a transition fuel towards more sustainable energy systems. In the developing world, the gas infrastructure is improving and replacing more carbon-intensive energy sources in baseload generation. On a global scale, the role of gas will change, as renewable energy sources will impact the running hour of baseload generation, and more system flexibility will be required. Flexible gas technology will have a key role to play in countries where the energy transition is more advanced, as well as in developing countries seeking future-proof baseload technology.

Hydrogen and synthetic fuels offer interesting possibilities for decarbonised power generation in the future. In a power system that incorporates renewables and battery storage, some of the excess renewable energy could be used in the production of green hydrogen to fuel power plants that balance the power system when cloudy or calm weather reduces the output of solar and wind power plants. Green hydrogen produced via electrolysis could be used as a fuel as such, or could be synthesised to facilitate its handling and use. Hydrogen and synthetic fuels are especially valuable in providing medium and longterm flexibility, as they can be stored and transported when needed. In addition to technology development, wider adoption of hydrogen in power or other sectors, such as industry or transportation, would require extensive investments in infrastructure.

Technological progress, along with increasing power system complexity with intermittent renewable energy sources, is paving ways to use new digital technologies. Remote monitoring, as well as recommendations and forecasting enhanced by artificial intelligence, are becoming more common in power plant operations. New data, along with platformbased business models and solutions, enable system-level integration and asset base optimisation throughout the entire lifecycle of the assets.

Energy markets in 2024

The energy transition continued to advance, with wind and solar expected to post record installations in 2024 and 2025, reaching 650 GW to almost 800 GW of combined capacity additions in 2025 according to the International Energy Agency (IEA) and Bloomberg New Energy Finance (BNEF). The transition towards renewables is expected to continue to accelerate, since the main driver for wind and solar capacity additions is favourable economics.

Energy-related macroeconomic development in 2024 was impacted by elevated risks in the geopolitical environment. Uncertainty increased in the fourth quarter due to US trade policy, as the incoming administration signalled its intention to impose or increase broad tariffs on imports to the United States. While the scale and scope of the potential tariffs remain uncertain, they may have widespread impacts on energy markets in and outside the US. The impact of the new US administration on the energy transition globally is likely to be muted.

While the macroeconomic environment has made project financing difficult, decreasing inflation and interest rates are expected to encourage investment decisions in the mid- to long-term.

In 2024, commodity prices were relatively stable compared to the previous few years. Global natural gas prices increased in the second half of the year. Prices for lithium continued to decrease after declining significantly already the previous year.

In engine power plants, market demand for equipment in 2024 improved compared to the previous year, while demand for services remained stable. In the balancing segment, the pace of the renewable energy transition continued to be an important demand driver. The total market for thermal balancing in the first three quarters of 2024 was larger than in any previous full year according to data from the McCoy Power Report and gathered internally. The drivers for balancing demand are also expected to develop favourably in 2025. The baseload segment remains a strong source of demand for thermal power. Reciprocating engines are important providers of baseload generation, particularly in remote locations and other locations where access to grid power is uncertain or time-sensitive, such as data centres. Baseload generation demand is expected to remain stable.

In battery energy storage, demand is closely linked to the increasing share of intermittent renewables in the energy system, which continued to progress strongly. The market for utility-scale battery storage is expected to continue with strong volume growth this decade and onwards, with the Global Energy Storage and Grids Pledge at COP29 having targeted a cumulative 1,500 GW of energy storage capacity by 2050.

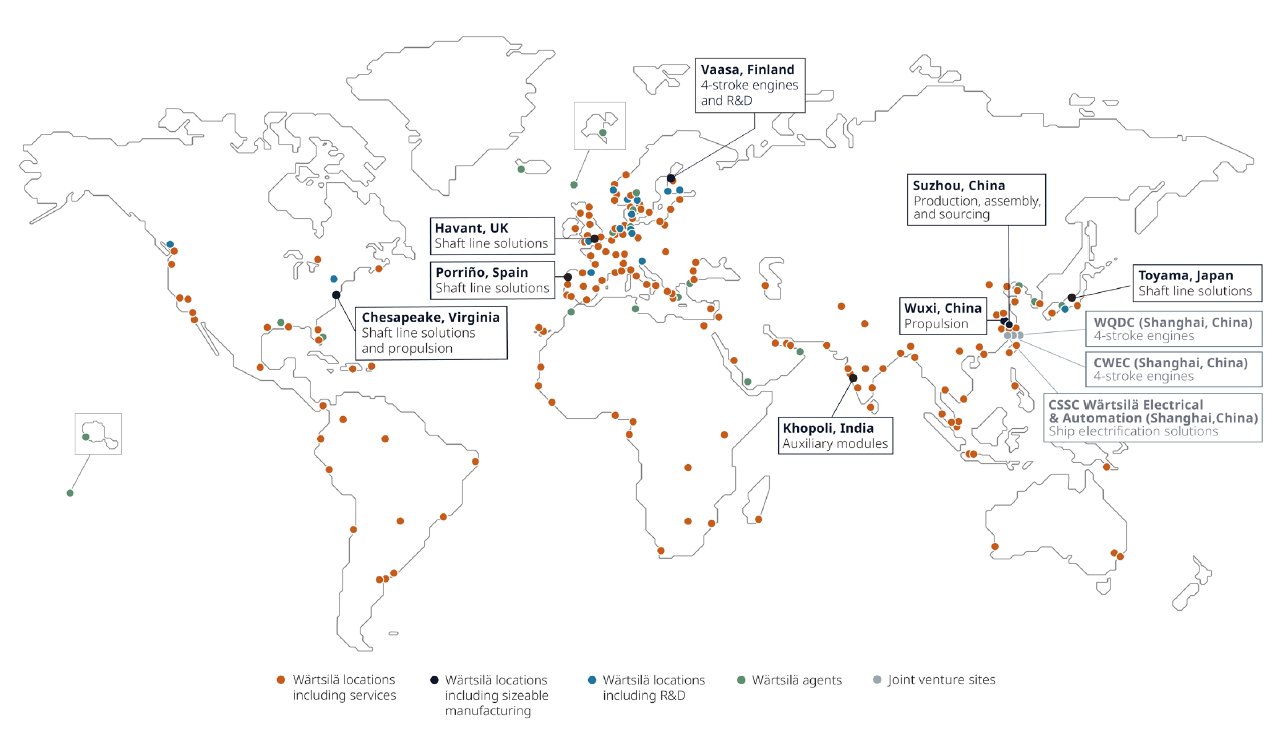

Wärtsiläs global reach

Wärtsilä is a global leader in innovative technologies and lifecycle solutions for the marine and energy markets. To support our geographically dispersed customer base, Wärtsilä’s sales and service network covers more than 230 locations in 77 countries worldwide. With 190 years of experience, emphasising the importance of developing long-term relationships, we partner with subsidiaries, joint ventures, and a global network of suppliers.