General/market environment

During the third quarter of 2022, uncertainty about economic development and geopolitical tensions continued. Intensifying cost inflation, prevailing disturbances in supply chains, tightening monetary policies, and challenging macro environment are creating turbulence within the global business environment. Despite the challenging market conditions, we were able to clearly grow our order intake.

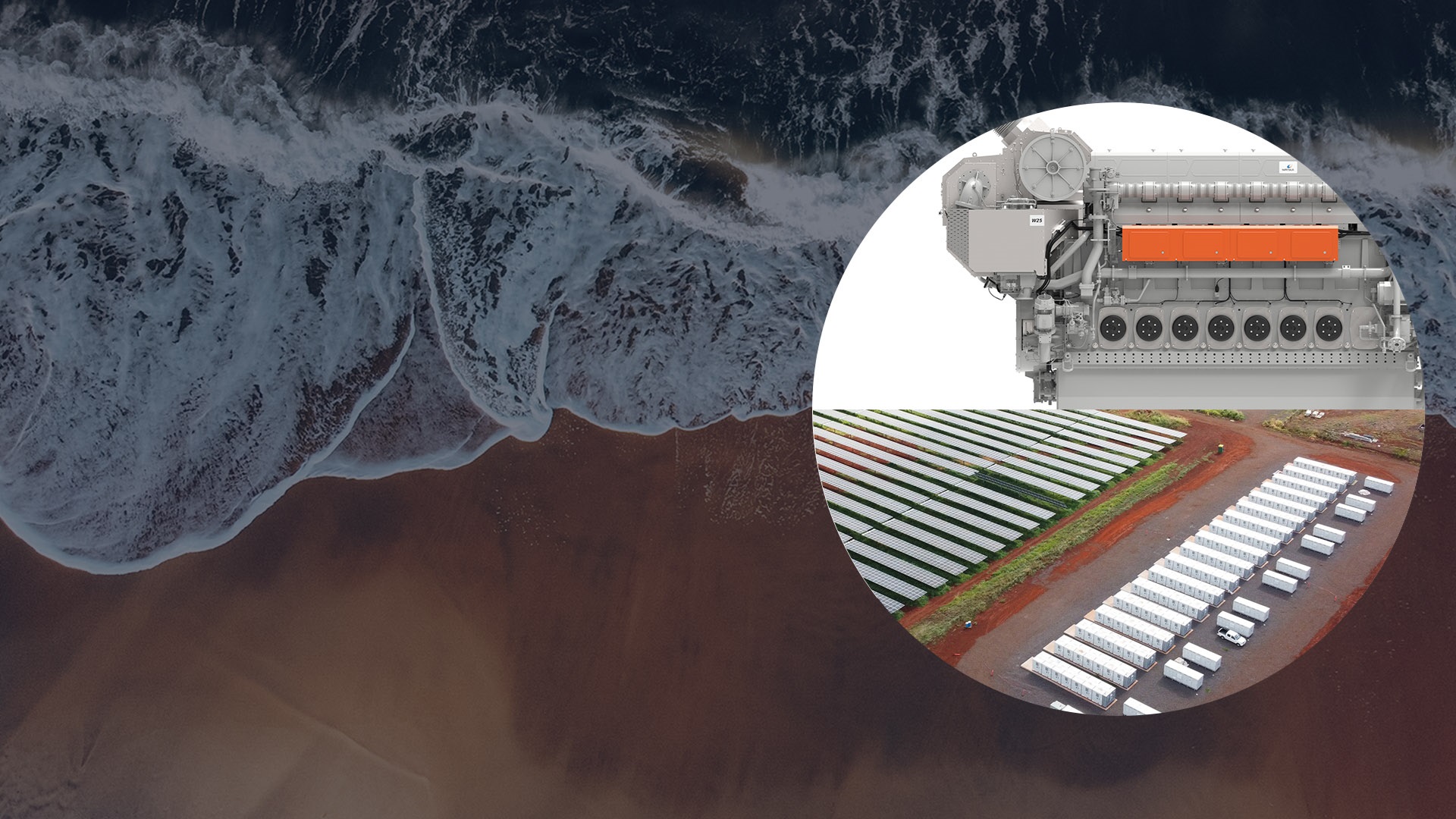

The energy market remained volatile. Nevertheless, we again received important orders notably for thermal balancing and energy storage solutions. For example, we will deliver a total of 2 GWh of energy storage systems for one of the world’s largest solar-plus-storage project portfolios in California and Hawaii. One of the proof points on how we integrate renewables with our flexible engine technology is the order of ten Wärtsilä 34SG gas engines to a Japanese power plant, where they will replace a 100 MW combined cycle gas turbine. In Q3, 70% of thermal orders were related to balancing power. The service business in Energy also continued to perform very well, and we were awarded several upgrade projects and long-term service agreements.

Similarly in the marine markets, the service business remained on a good track. The active cruise fleet has been well over 90% on average during the quarter, the offshore fleet witnessed increasing utilisation and day rates, and the demand for LNG cargoes has exceeded the available supply. However, the demand for new ships has moderated during the year, as many shipyards are operating at close to full capacity, and prices have increased. Our position as a frontrunner in marine technology was demonstrated with an order to supply a propulsion package for the world’s largest aluminium catamaran. It will operate between Argentina and Uruguay with our dual-fuel engine technology.

Order intake

Total order intake increased by 36% and service order intake by 27%. High utilisation of vessels and power plants continued to support the service business in both Marine Power and Energy. Our customers are also showing increasing interest in long-term agreements. The positive development of equipment orders was driven by demand for both energy and marine equipment.

Net sales and operating result

Net sales increased by 30%, driven by growth in all businesses, except Voyage. New equipment sales grew by 49%, while services grew by 13%. Our comparable operating result decreased by 6%, mainly due to cost inflation, a less favourable sales mix between equipment and services, higher storage volumes, and declined profitability of Voyage.

Cash flow and financial position

Wärtsilä’s cash flow from operating activities in July-September amounted to EUR 100 million (49). Positive development of the cash flow was supported by customer payments received and increased payables, whereas inventory increase had a negative impact. Wärtsilä’s asset-light business model, strong cash generation ability, and high service volumes deliver overall operational stability.

Outlook (near-term)

We expect the demand environment in the fourth quarter to be weaker than that of the corresponding period in the previous year. This reflects the fact that order intake in the last quarter of 2021 was at an all-time high. For the full year 2022, the demand is expected to be slightly higher than in the previous year.

The share of equipment sales relative to service sales will be higher in 2022 compared to 2021. Cost inflation is anticipated to remain high in the last quarter of 2022 and we continue to implement price realisation and continuous improvement to mitigate the impact of cost inflation. We are executing our strategy to make Wärtsilä a stronger and a better company. Order intake and sales are growing and we are making considerable progress in developing the solutions to shape the decarbonisation of marine and energy. We are moving up the service value ladder and increasing the performance-based service agreements. We are also simplifying our organisation and are addressing our cost structure. The decarbonisation journey will transform our industries and Wärtsilä is very well positioned to play a key role there.

You expect the Q4 demand environment to be “weaker” y-o-y – what kind of a decrease in order intake in % would that translate into, and what are the drivers behind it?

This reflects the fact that order intake in the last quarter of 2021 was at a record high level. The prevailing market conditions make the outlook uncertain. However, it is still difficult to put a number on it, due to many uncertainties in the market. We have seen an acceleration of cost inflation, which may slow down order intake. The global economic development is also difficult to predict. Please also note, that we said that for the full year 2022, the demand is expected to be slightly higher than in the previous year. Finally, the timing of large value orders can have a big impact on stand-alone quarterly figures.

What are the biggest opportunities and headwinds in terms of orders and EBIT for the rest of the year and for 2023?

The main drivers for order intake are the expected good activity in the Energy market (both thermal and storage), but also the continued positive service business activities in both the energy and marine markets. However, market uncertainty is high, and we need to be prepared for volatility also going forward. EBIT should be supported by a good sales volume development especially in service, while being burdened by sanctions on Russia, high cost inflation, supply chain bottlenecks, and a less favourable sales mix due to the strong growth in equipment deliveries.

There are lots of recession fears on the market. What is your plan B, if Western economies land in a recession in Q4 or 2023?

We have a good order backlog, which gives certain visibility. In addition, our service business is a fairly stable business. Naturally, in the case demand and order intake weakens severely, we need to adjust our cost base accordingly.

What are your assumptions for cost inflation going forward? Have we reached the peak?

This is very difficult to estimate and varies between cost items, geographies, and businesses. The increased energy price is impacting the prices of certain components, while salary inflation pressure is very different in different geographies depending on cost of living, governmental support, and labour market conditions.

What should we expect for items affecting comparability (IAC) for the full year of 2022?

We expect to recognise roughly MEUR 90-100 of IAC during H2, of which the far majority relates to the downscaling of Trieste manufacturing. In Q3 we booked IAC items for 72 MEUR, almost completely related to Trieste.

How is the demand for Navy business developing? Defence investments are increasing, is it fair to assume that Wärtsilä will benefit from those?

Defence investments are indeed increasing as we see new programs and program extensions being announced by several navies. However, the time horizon in which these projects shall materialize are typically very long, between 5 and 15 years. Consequently, on short term we do not expect to see material increase on navy newbuild business.

What actions are you taking to improve profitability of the Voyage business, and what kind of progress have you seen in your turnaround plan? Are further actions needed?

Turnaround has proceeded slower than we anticipated due to Covid and the closure of the operations in Russia. It was recently announced that Voyage will be integrated with Marine Power from the beginning of 2023 to strengthen end-to-end offering and to accelerate turnaround.

Was Voyage’s weak Q3 result in line with your own expectations?

Results were lower than we anticipated. Our efforts to rebuild R&D and project management capabilities outside Russia were resulting in some deployment delays and additional costs. In addition, cost inflation was higher than anticipated.

How do you see the European energy crisis on your demand? Does it clearly increase your demand in Energy?

The European energy crisis affects the market landscape in a couple of ways. On the short-term, price and availability of gas causes some uncertainty and likely postponements in finalizing investment decisions. However, our customers base their decisions on an outlook over decades, while the energy crisis should ease in a matter of a few years.

What is Wärtsilä’s competitive position in Europe? Should you invest now more in resources in Europe as the Energy crisis is accelerating the demand?

We have a solid resource base in Europe to serve the energy market. Our competitive position for the future is strong, because of the flexibility of our engines. The rapidly advancing energy transition moves gas and liquid demand from baseload to balancing especially in Europe, where Wärtsilä has been able to secure orders for flexible capacity. However, with relation to engine power plants, the energy crisis is likely to cause delays in investment decisions in the short term due to the tight availability of gas. On battery energy storage, the outlook has indeed improved in Europe.

Energy comparable operating margin declined clearly y-o-y, even though net sales increased by 43%, why? Is the Q3 margin a relevant proxy for future quarters with the existing order backlog?

Main driver for the declined operating margin % is the mix with less Services and more Equipment sales. In addition, within Equipment volumes, the loss-making Storage business represented a significantly bigger portion than in comparison period. In storage, we delivered orders already received last year, i.e. before the cost inflation accelerated.

How much did energy storage contribute to orders, net sales, and EBIT?

Energy storage represented around 60% of total energy equipment orders in Q3 (MEUR ~320 vs. MEUR ~280 in Q3/21), while it represented around 45% (MEUR ~200 vs. MEUR ~120 in Q3/21) of total energy equipment sales. The profitability of energy storage business is currently negative.

Are you already seeing the positive impact of the Inflation Reduction Act in the US on demand of energy solutions?

Customers have expressed a positive sentiment related to the introduction of the IRA, however full implications of the package are not expected to be clear before early 2023. In the big picture, battery energy storage projects in the US are expected to clearly increase as a result. Further, over time we are expecting an increase in US-based battery technology manufacturing.

How are you proceeding with the energy storage turnaround plan?

The turnaround plan is proceeding well. The plan is to a great extent based on higher volumes, better cost leverage as well as improved product costs. We also progress well to scale power system optimisation based on GEMS software and AI. The solid order intake in Q3 supports our turnaround plan, especially as new orders were booked at prices that were updated for cost inflation.