We hosted a

Marine-themed investor call with our President

of Wärtsilä Marine, Roger

Holm, and CFO, Arjen Berends on May 7. The target of the call was to discuss Wärtsilä's Marine

business opportunities and offer a

chance to ask questions regarding the topic.

The recording

of the call is available here and the

presentation slides are here.

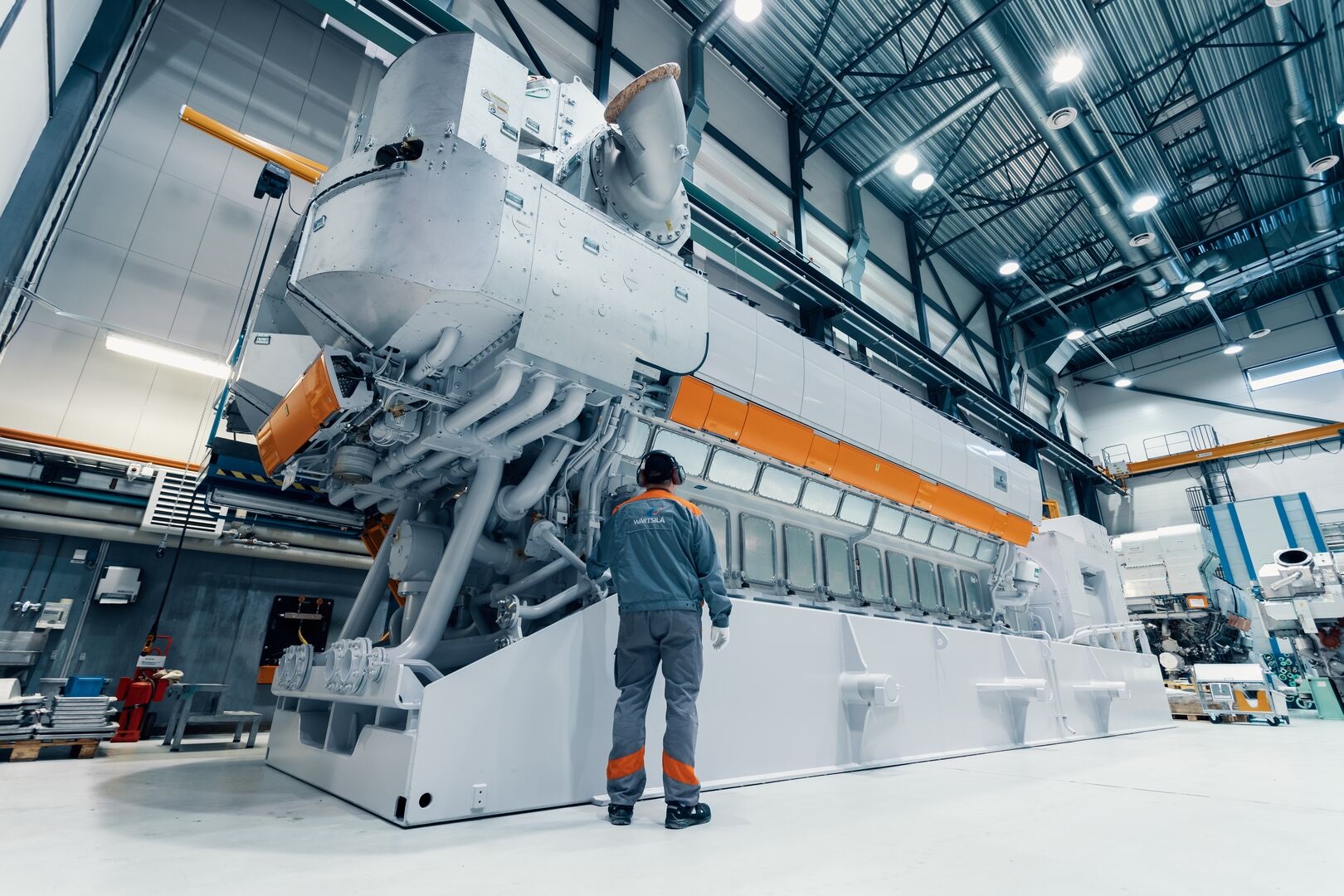

Roger started

the call by discussing marine market growth, and decarbonisation transforming

the industry in an unprecedented way. The transformation is driving Wärtsilä’s

Marine business, which is growing in sales and improving profitability.

Wärtsilä is a

technology leader in new fuels and hybrid solutions, having the industry’s most

comprehensive offering for alternative fuels. Last year, Wärtsilä increased the

R&D spending target, from an annual ~3% to an annual ~4% of net sales to

further support the decarbonisation targets. Wärtsilä wants to have a future-proof

and flexible product offering, which customers can rely on, especially given

the tightening regulation environment. The move into alternative fuels is also

driving the value proposition of service agreements, as the solutions get more technologically

advanced and complex. For Wärtsilä’s Marine business, installations under

agreement grew by 38% since 2019, and the renewal rate of the agreements has

been around 90%.

Decarbonisation

is transforming the Marine industry and driving Wärtsilä’s growth

The marine

industry is moving from a single-fuel environment to a multi-fuel environment.

Methanol and ammonia are seen as the likely alternative fuels to be used, as they require less space on the vessel

than other green alternatives. We, in Wärtsilä, see a clear uptake of methanol already,

and estimate that ammonia will follow. Around half of the overall order book

today, looking at a gross tonnage of ships, is already going for alternative

fuels, including LNG. For example, 60% of containerships contracted in

2023-2024 will be capable to run on methanol.

Wärtsilä’s focus is on the high-value, performance-driven

segments, such as cruise, ferry, and offshore. Wärtsilä’s market share on 4-stroke medium-speed engines

in megawatts for cruise is ~85%, for ferries ~65%, and for offshore ~55%. The

global cruise capacity is forecasted to grow by over 10% from 2024 to 2028.

Cruise travel has reached 107% growth of 2019 levels, indicating a better

development than general tourism.

In Wärtsilä’s equipment business, decarbonisation is strengthening the market position as we

want to lead in both fuel flexibility and efficiency. The market growth is supported by Wärtsilä’s

comprehensive offering of alternative fuel engines and extensive experience in

the industry. For example, Wärtsilä’s

market share in 4-stroke

medium speed main engines running on alternative fuels is ~75%, compared to ~45%

on all fuels. The equipment order intake has been developing positively, with

alternative fuel-capable engines for Wärtsilä accounting for more than 60% of

the megawatts ordered in 2023. The interest of methanol has grown faster than

expected, and ammonia is also gaining interest.

Wärtsilä’s

strategy of moving up the service value ladder, solid installed base, and decarbonisation-driven

retrofits are driving the growth in the service business. Tightening

regulations and rising fuel and emission costs are increasing the demand for retrofits. An estimated 53% of the fleet will not be CII

compliant (Carbon Intensity Indicator) in 2024, which may increase the demand of

various retrofit solutions. Total investments in retrofits are estimated to be

EUR 15-20 billion over the next decade. Examples of retrofit solutions include

propulsion efficiency upgrades, alternative fuel conversions, radical power

derating, and electrification projects. The key challenge

is to balance the speed of decarbonization with financial feasibility.

Tightening regulations and increasing fuel and

emission cost will boost demand for retrofits and alternative fuel-capable

engines

IMO

(International Maritime Organisation) upgraded the regulation targets in July 2023

to net-zero emission reduction targets for 2050. This accelerates

the speed of the decarbonisation journey on a global scale because, in

shipping, vessel lifetime is long. The ships ordered today, will

be still operating in 2050. In the EU, the regulations are accelerating the

growing costs of using fossil fuels within EU waters. The fuel costs may double

due to emission fees up to 2030, compared to 2023. The EU has implemented measures to ensure that if

one is not paying for the ETS (Emissions Trading System) allowances and not

meeting the targets, there will be both

financial and operational penalties. This will be monitored by the member states. Those not following the regulations will be

publicly listed, and if non-compliance continues for too long, they will be banned from

entering EU ports. It is expected that during 2025, also the International

Maritime Organization (IMO) will clarify more rules about the financial

implications.

Onboard CCS

can unlock EUR ~10bn business in the next 10 years

Carbon Capture

and Storage (CCS) is seen as a significant market opportunity in the coming

decade, helping to drive the decarbonisation journey.

CCS will allow to capture over 70% of the CO2 generated by carbon-based fuels.

Good development has been seen in Norway, where the first full-scale

installations will be done in Q4 2024. The targeted commercial market release will

be in 2025.

Q&A

According to your presentation, more than half

of the ships are currently non-compliant with the CII regulation. What

will non-compliant ships do in practice?

Many non-compliant ships are already doing slow steaming to

improve efficiency and compliance. This involves operating at slower speeds to

reduce fuel consumption and emissions. Ships that fall into the two lowest

categories (D and E) under the CII regulation need to create an

action plan to improve their carbon intensity. This could involve

propulsion efficiency upgrades or fuel retrofits, although the latter is seen

as a last resort and is not yet widely implemented. Different efficiency

upgrades can be done on a vessel to extend its compliant years. The

process of improving compliance and efficiency is seen as a

development journey that will accelerate over the coming decade.

Regarding

the merchant segment, which vessel types does Wärtsilä have a strong market position in, in terms of both main

engine and auxiliary engines?

The LNG carriers are

sold with 2-stroke main engines

and 4-stroke auxiliary engines. We provide dual fuel engines as auxiliary

engines to LNG carriers. We are also targeting to change this segment towards

hybrid electric where we would have 4-stroke main engines. For

smaller merchants like chemical tankers, we can offer 4-stroke main engines,

but the big volumes come from auxiliary engines.

Overall Clarkson’s ship contracting statistics

seems to have little bearing on Wärtsilä’s demand scenario. What is the reason

for that?

Although we also provide 4-stroke auxiliary engines, our sweet

spot is in vessel segments with 4-stroke main engines. Clarkson’s statistics include

all vessel contracting, and for that reason Wärtsilä’s orders might not always

correlate with that. For example, in 2021, vessel contracting grew

significantly, but the growth was driven by bulk carriers, which isn’t that

significant of a segment for Wärtsilä from an engine point of view.

Regarding

the enforcement of regulations, how much those might affect customers’ investments

into either new engines or

retrofits?

The regulations in the EU are driving customers decisions. The EU regulations are not only driving the EU-owned vessels but everyone

operating in the EU ports and waters. We

have talked to Chinese customers, for example, where they state clearly that

the reason why they want to make

development to their vessels now

is related to the EU regulations because they will operate in EU waters. We

expect to see more clear rules on the IMO regulations and actions from

2025 onwards.

How do

you see the competitive environment developing in the CCS market?

We expect to be among the earlier entry points into this

market with our technology and

capability. However, there will be a development of different

competitors over time, but we are

well on time with our development for

the market.

How will the regulations treat carbon capture

as a solution? Is there any concern that it would slow the uptake of new fuels,

or is it just mainly a retrofit solution that would solve a

situation where new fuels wouldn't be applicable?

For the green fuels’ development and IMO regulations, there

are still decisions to be made regarding the applicability and treatment of

carbon capture solutions. However, we don’t expect challenges regarding that. From the vessels' point

of view, the solution is applicable for both 2-stroke and 4-stroke engines, but

the biggest opportunity will be for 2-stroke vessels,

especially on the retrofit side.

You mentioned that decarbonisation is

strengthening Wärtsilä’s position and market share in the equipment

business. Is that because of the technical capabilities of alternative fuel engines

or aftermarket capabilities?

The key element when choosing the engine provider is

the technical capabilities of fuel flexibility, which is our strength. Customers are

considering the long-term implications of their choice. They might initially

choose a dual-fuel diesel-LNG engine, but they also consider the

potential need to upgrade to a different fuel during

the vessel’s lifetime. They want to ensure that their chosen

supplier will still be around in ten years, capable of supporting upgrades

to fuels that may not even exist today. The wrong choice could negatively

impact the value of their vessel. The extensive global service network is

another key factor in decision-making. This network is

valuable regardless of the fuel chosen, but it becomes even more important when

dealing with more complex technical solutions. The fact that Wärtsilä has a

presence in all necessary locations is a significant advantage when selecting a

new engine.

You

stated that the installations under agreement grew by 38% since 2019. How common it

is to get the engines under

contract, and where do you see that to develop in the coming years in terms of retention

of the installed base on the service agreements?

The interest in agreements increases the more complex

vessels or technical solutions you go for. Going towards new green fuels will most likely even further increase

the interest in doing an agreement because

the customer itself will

not have the knowledge to deal with all parts. We

have a lot of knowledge ahead of the customers based on our testing, our developments, and the training of the crew. So, we firmly believe that

agreement interest will continue to develop in a positive direction in this

transformation.

When will you have the full product

portfolio available for methanol and ammonia engines?

For methanol, a

broad portfolio has already been

launched. As for ammonia, the process

is still in the early stages. The Wärtsilä 25 is the only model that has been launched so

far. More engines running on ammonia are

planned. The first model is always the most challenging

because once the technology is proven to work, productising the rest is a smaller step. The

current focus with ammonia is to demonstrate that the technology is efficient

and works well with the combustion engine. More products will be released based

on market demand. While a timeline for when a larger portfolio

for ammonia will be available has not been

published yet, it will

be determined based on market needs.

What kind of changes do you need in case you

start running the engines with biofuels or hydrogen?

Wärtsilä diesel and Dual Fuel (DF) engines can operate on biofuels without any modifications, provided that the biofuels meet specific pre-defined fuel characteristics. For ship operators or owners planning to use biofuels in their vessels, we provide biofuel specifications. Wärtsilä has successfully operated a commercially used power plant gas engine on a 25 vol % hydrogen blend without any engine modifications. However, using higher levels of hydrogen typically necessitates some changes.