China’s National Energy Administration (NEA) recently issued a new policy guidance for generation companies to add balancing capacity and update the administrative measure of power ancillary services.

This policy update will promote the growth and development of power ancillary services. It’s the first time in decades that this regulation has been revised, signalling NEA’s support of China’s energy transition and the nation’s dual goal of having carbon emissions peak by 2030 and being carbon neutral by 2060.

According to NEA at a recent press conference, ‘the new policy will significantly boost renewable energy adoption throughout the economy by ensuring adequate integration and balancing power for industries and generation companies. Power ancillary services are crucial components in securing a power system’s safety and operational stability, while ensuring the quality of the electricity generated. Their role in supporting the grid and the integration of renewables has grown at a frenetic pace. For industries to improve the quality of their power supply and ensure efficient resource allocation, a well-formulated ancillary services market and policy is essential.

According to the NEA, power ancillary services account for 1.5% of China’s total social electricity costs, with this figure expected to rise to 3% in the near future. Increasing intermittency creates a rising demand for a fast-ramping balancing response and grid stability support. This growth will escalate as new energy forms are adopted at a large scale across industries and economies.

Malin Östman, General Manager, Project and Market Development at Wärtsilä Energy, was optimistic about the positive changes that the new direction in policy would bring: “Forecasts predict that China’s ancillary services market could be worth 200 billion yuan as demand grows. There’s a need for technological innovation to keep in step with policy development and the increasing amount of renewable energy. Flexible and fast responding technologies can bring stability, balance, and efficiency to the power system, and serve an important role in the ancillary services market.”

Ancillary services are many and varied, though their main purpose is to support a stable grid and integrate variable renewable energy into the system. China’s ancillary services are dominated by peak shaving, reserves, voltage regulation, and frequency regulation. Peak shaving allocates power according to predictable demand patterns, while reserves provide back-up for the entire system. Frequency regulation deals with power supply that is harder to predict from renewable energy sources that rely on weather conditions like wind and solar. In these cases, frequency regulation stabilises the power grid by ensuring that, for example, backup batteries can power up in seconds to make up for a shortfall when the weather conditions are not ideal, or power off when the weather clears.

New technologies are paving the way

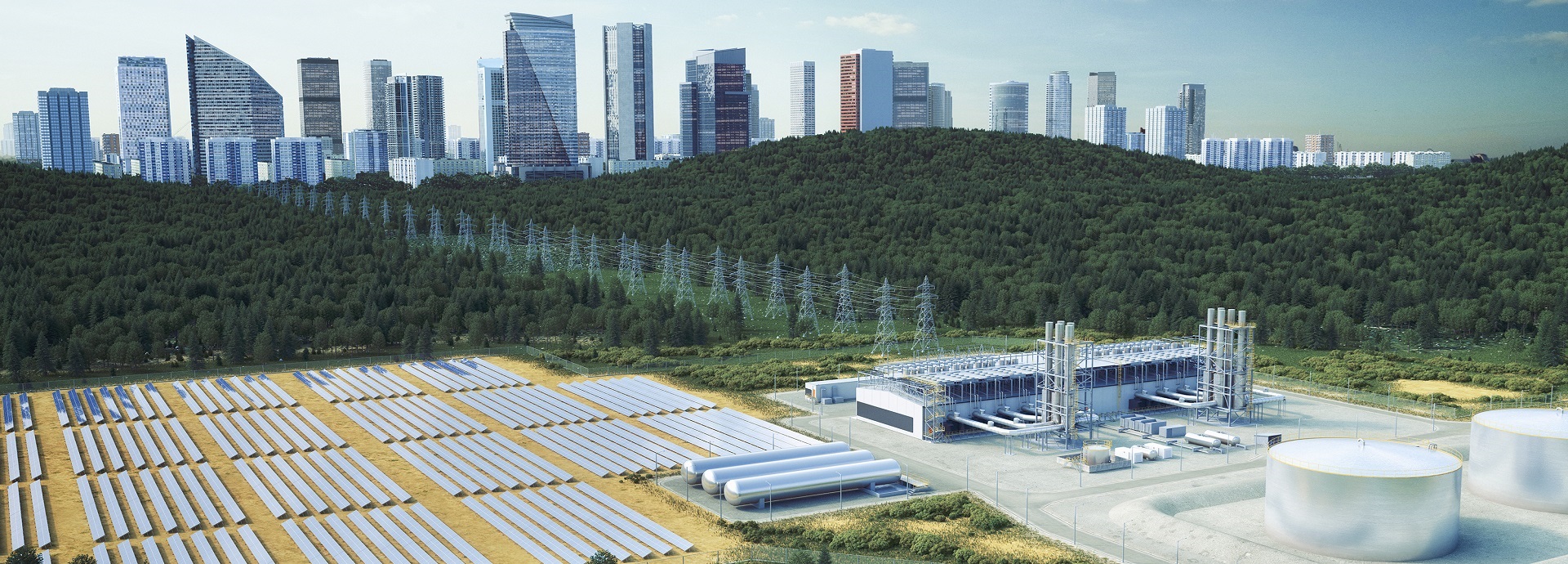

At present, grid balancing power plants serve as the main providers of ancillary services in the domestic market. As the renewable energy sector grows, aided by policy shifts and technological advances, thermal power units will need to improve regulating capacities and switch to faster responding technologies. Frequency regulation will increase in importance as the need for flexibility grows.

The four key parameters that define the flexibility value of assets providing frequency regulation are ramp rate, standard regulation velocity, accuracy of power control, and standard regulation accuracy. There are many types of technologies that provide ancillary services, though each comes with its own advantages and limitations. When considering frequency regulation performance, energy storage is the most effective option, followed by engines and hydropower via pumped storage. Traditional coal-fired power generation is slower to respond in terms of regulation rate. Grid balancing technology, such as the internal combustion engine, also boasts higher energy density and better peak capability than its counterparts.

The faster a plant can respond to power fluctuations, the better it is for the system. While coal’s ramp rates are only 2%/min, hydropower reaches 20%/min of installed capacity, and the grid balancing engine can reach over 50%/min of total capacity, while hydropower reaches 20%/min of installed capacity. This means that while traditional units can take over 30 mins to start up, grid balancing power plants e.g. ICE, hydropower plants and electrochemical energy storage can cut response times down to a few minutes, or even a matter of seconds.

These innovative new technologies have paved the way for this new ancillary services policy. The new regulations will lead towards modern power systems that are optimised and able to integrate large volumes of renewable energy. This bodes well for China’s ambition to have carbon emissions peak by 2030 and be carbon neutral by 2060.

Looking ahead

The future looks promising for China’s power markets and ancillary services sector. The NEA’s proposal that the power spot market could replace the separate peak-shaving market currently in operation, is a clear indicator on how the next few years could unfold.

In most of China’s provinces, the power spot market is yet to be established or in trial stage, with the compensation mechanism for peak-shaving ancillary still to be worked out. In some regions, a power spot market has been trialed where the market has played the role of peak shaving. In Shanxi Province for instance, the spot market has played a regulating role and could lead the way to a more efficient allocation of resources. For example, when there is sufficient renewable energy, the price of coal will be lowered by the spot market and may result in coal being shut down.

The impact of China’s dual carbon goal and NEA policy will have a far-reaching effect on the power ancillary services market. These services will not only make the power system safe and stable, but will incentivise the adoption of clean renewable energy, and lead to large-scale wind and solar projects that bring in substantial environmental benefits as well as economic rewards.

Rhonin Zhou, Senior Manager, Market Development for Wärtsilä Energy noted the challenges that this change in regulation and policy would present to the industry: "The new policy will encourage generation companies to build balancing capacity and enhance their energy portfolio. But compensation mechanisms for ancillary services need to be clarified and market rules be put in place to bring investment into balancing technologies."

As the demand for fast-responding, flexible technologies grow, companies and power plants should be incentivised and encouraged to provide ancillary services. Allowing market forces to guide the direction of the ancillary services market will bring new players and technologies into the market and help move China closer towards the ambitious but important and necessary dual carbon goal.