The EU electricity market system does not work anymore. We have to reform it. We have to adapt it to the new realities of dominant renewables.

Approaching Europe's decarbonisation goals

The European Commission needs to reform its electricity market design to place a value on flexible capacity technologies for the EU to achieve its net zero targets and improve energy security

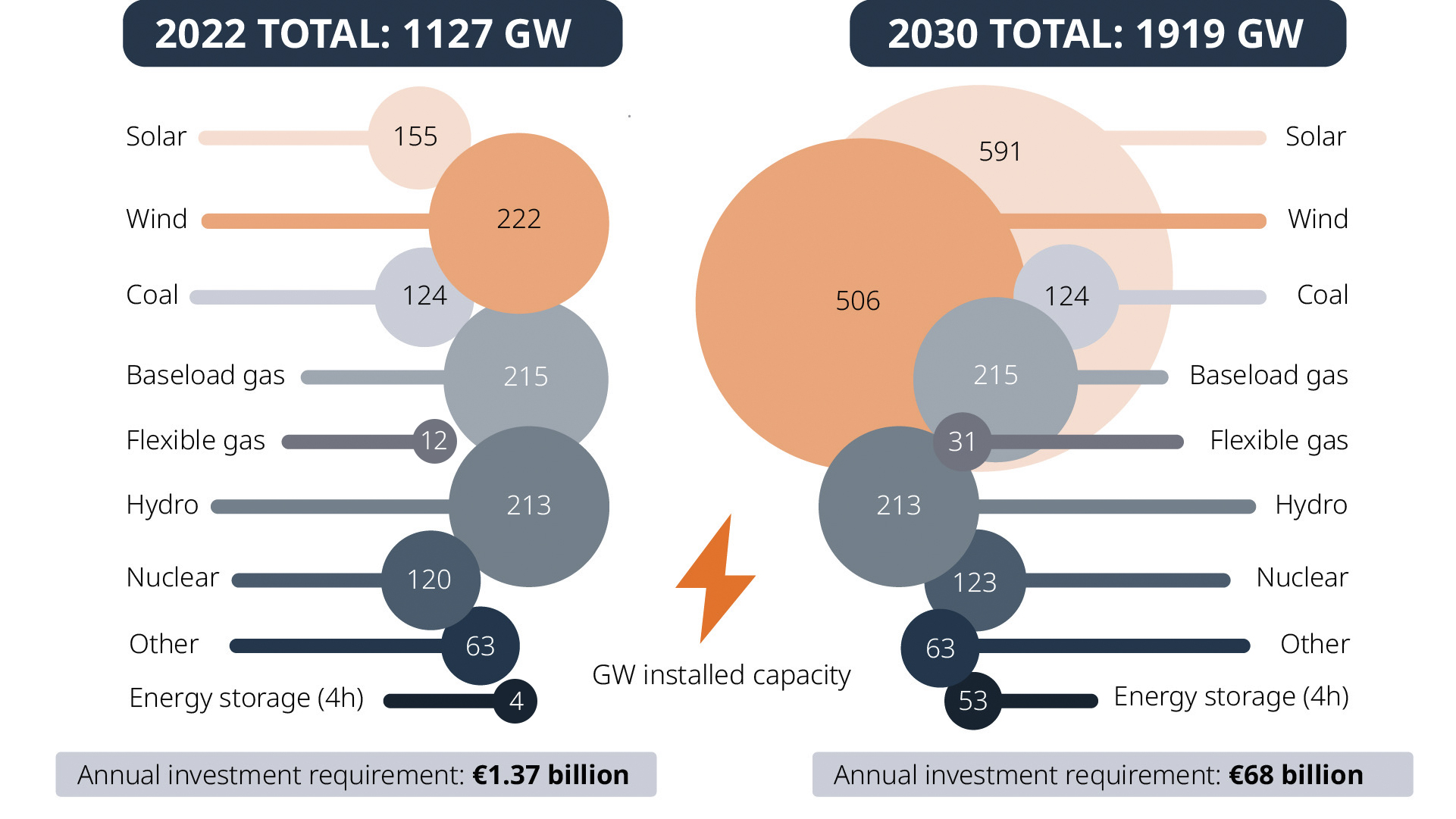

Europe will require at least 1,100 GW of renewable capacity by 2030 to continue its decarbonisation journey and increase energy security. However, for a renewable-based system of this scale to run reliably, it must be supported by 19 GW of new flexible gas capacity and 50 GW of energy storage to deliver power at times of low generation, according to Wärtsilä modelling. To enable 100% renewable energy systems, the grid balancing gas engines can be converted to run on sustainable fuels such as hydrogen, when these become readily available.

Achieving Europe's decarbonisation goals will not be a simple task, but it can be sorted out.

1100

GW

Required renewable capacity to reach decarbonisation goals

19

GW

Flexible gas capacity needed for a reliable renewable-based system

50

GW

Energy storage for power during low generation periods

We stand at the precipice of a transformational shift in European electricity systems, as wind and solar become the dominant power source to achieve net zero. However, the transition cannot be delivered by renewables alone.

Balancing a 1,100 GW renewable system

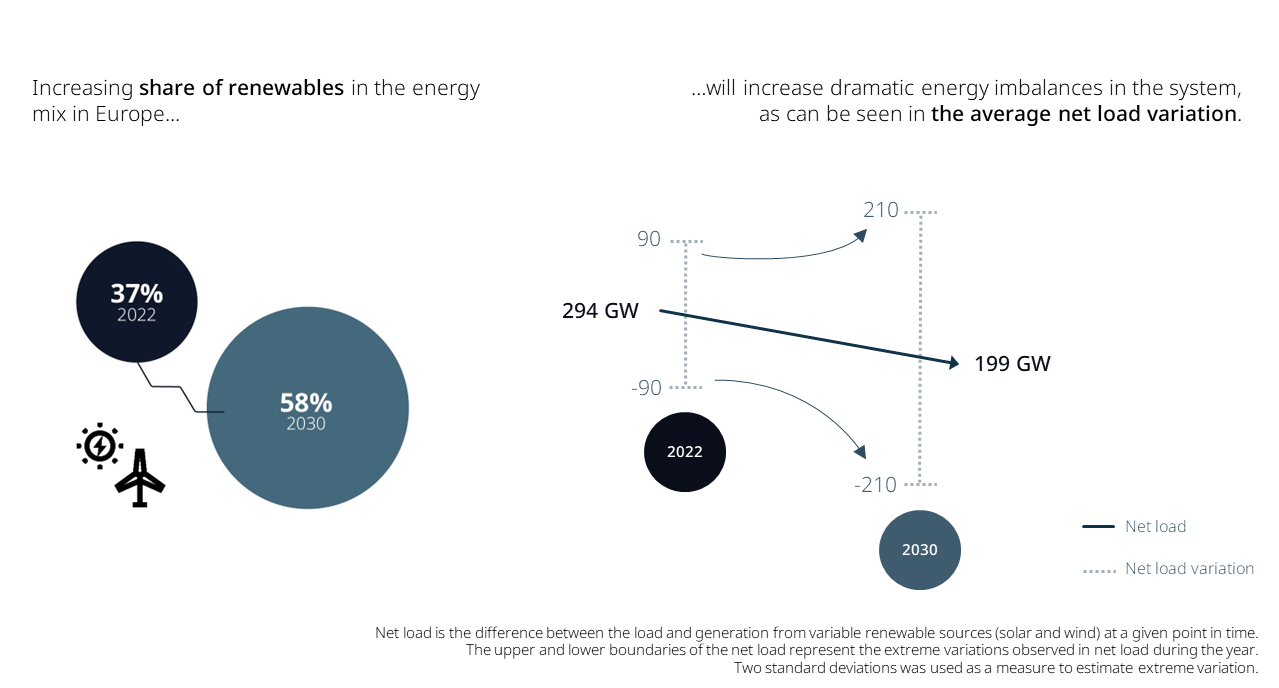

The inherent variability of renewables means the power supplied by a system powered by 1,100 GW of wind and solar could vary by as much as 500 GW over the course of a year. Flexible balancing capacity is urgently needed to plug the supply gap during these periods of imbalance.

Wärtsilä conducted a model of EU power systems which demonstrates that balancing technologies like reciprocating engines and energy storage will play a crucial role in the EU power system, accounting for 19% share of electricity generation by 2030. The study found that these technologies will need to operate for a few hours each day to ensure grid stability.

Moving towards a capability market

Relying solely on peak prices to recover the cost of investment and operations for flexible balancing power capacity with low operating hours will not attract investors or potential owners of such power plants.

This highlights the need for a more comprehensive business model approach that takes into account the full range of benefits that these technologies can provide, such as balancing demand and supply, grid security and stability, to ensure their continued development and deployment.

In essence, the design of the EU’s current incentives for investment in flexible balancing power capacity risk undermining investment, causing a major bottleneck in the energy transition. Wärtsilä’s modelling shows that the investment case for flexible balancing power capacity could become even more challenging in the future without the right market pricing mechanisms for balancing power.

Key Recommendations

The study includes a number of key recommendations for market reform, including calls for the European Commission to:

Define a technology agnostic regulatory framework - creating a new capability market to attract investments in flexible balancing power capacity to support renewables

Challenge:

Europe has invested upwards of 4.7 billion EUR over recent years to add new capacity to the system, however, this has predominantly been inflexible fossil fuel baseload assets which are costly and incompatible with intermittent renewables. These investments occurred against the backdrop of current mechanisms which guarantee generation capacity but do not consider how well it facilitates renewable energy targets.

Solution:

It is, therefore, imperative to put in place a capability market in Europe that will drive investments in balancing plants. A capability market would reward power plants that provide reliable firm capacity and offer well-defined operational attributes that enable them to provide essential services to the electrical system to maintain grid stability. Such attribute-based capacity addition is a more targeted and efficient way to drive investment in the generation assets of the future.

Improve price transparency to stimulate growth for flexible balancing power capacity services to support renewables

Challenge:

Existing inflexible technologies which today provide support services to the grid, such as coal, nuclear or Combined Cycle Gas Turbines, are designed to run at full load for long periods. This makes them unsuited to balance renewable-based grids which demand agile reserve power that can dynamically ramp up and down as needed. This leads to higher system costs, as assets are running longer than is required, and the unnecessary burning of fossil fuels, as renewables are curtailed in favour of inflexible fossil fuels.

Solution:

We should provide transparent prices for support services which offer clear investment signals to stimulate the growth of flexible, sustainable solutions.

Enable strong, granular price signals

Challenge:

The current electricity pricing system lacks transparency as it sets uniform prices across a large region without taking into account transmission limitations that affect the flow of electricity. This leads to higher costs for maintaining supply and demand balance, as the system operator is forced to continually adjust the dispatch of power plants.

Solution:

To address this, a more granular pricing system is needed, one that accurately reflects local supply and demand conditions at different locations within the grid, while taking into account the available transmission network. This will not only provide a clear picture of electricity prices, but also promote competition and enable efficient allocation of resources in the electricity market.

Articles

Press release & materials

Energy market reforms crucial for EU to achieve net zero goals, according to Wärtsilä study

Europe can halve power sector gas consumption for electricity and save EUR 323 billion by doubling new renewable energy, according to Wärtsilä report

Replacing coal with renewable generation and flexibility promises European energy independence, Wärtsilä finds